Displaying revenue and expense as a sales share simplifies period comparisons and performance assessments. In addition, financial statement evaluation is the first step investors take when evaluating a company’s profitability and viability as an investment. It offers a clear view of the company’s monetary health, together with profitability, liquidity, and debt management, constructing investor confidence in the company’s capability to generate returns and handle obligations. Ultimately, financial statement evaluation guides inner strategies and attracts exterior investment by showcasing financial power and resilience.

Analyzing Horizontal And Vertical Analysis

This provides you with insights into whether or not the corporate is outperforming or underperforming in comparability with its friends. In addition, comparative monetary statements assist you to benchmark your performance against trade requirements or competitors. This lets you see how nicely your corporation is doing compared to others in the same market and establish areas the place you may need to improve. Once you have chosen the period for comparability, the following step is to gather monetary information from each interval.

- In this part of financial assertion evaluation, we are going to evaluate the operational efficiency of the business.

- Suppose Active Footwear, a footwear manufacturing firm, ready a comparative assertion and found that its COGS, or cost of products bought, jumped from 25% to 50% of gross sales over two years.

- This allows college students to grasp adjustments in monetary performance from 12 months to year, spot tendencies and conduct related assessments in help of decision making.

- By analyzing the steadiness sheet, one can understand the company’s belongings, liabilities, and fairness, that are crucial for assessing its monetary position.

However, it is necessary to notice that horizontal analysis only reveals the changes in the monetary knowledge and does not present any explanations for the modifications. Comparative statements reveal how enterprise selections affect the corporate’s bottom line. Trends are recognized, and the performance of managers, new lines of enterprise, and new products may be evaluated, without having to flip by way of individual financial statements.

This data can be utilized to compare the company’s performance against its business and establish areas for enchancment. For instance, suppose a company’s income elevated from $100,000 in 2018 to $150,000 in 2019. In that case, the horizontal evaluation signifies that the company’s income elevated by 50%.

In this part, we will explore the importance of financial evaluation and how it could be used to assist businesses make more informed choices. While comparative monetary statements present valuable information about a company’s monetary performance, they also have some limitations. If a company modifications its accounting methods or fails to report accurate monetary information, comparative financial statements could also be deceptive. One Other challenge is that they might not provide a whole picture of a company’s financial well being https://www.simple-accounting.org/. For instance, they may not take into account non-financial factors, corresponding to modifications available in the market or changes in client conduct.

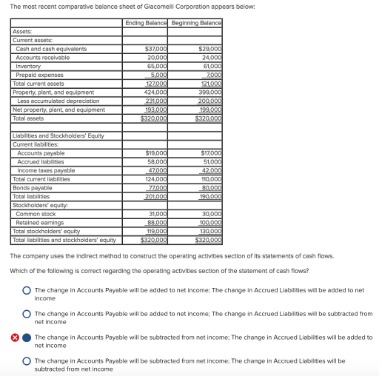

Comparative financial statements current the identical company’s financial statements for one or two successive durations in side-by-side columns. The calculation of dollar changes or proportion modifications within the assertion objects or totals is horizontal evaluation. When getting ready comparative financial statements, the first step is to pick the time durations for comparability, permitting for comprehensive period-to-period evaluation and pattern identification based mostly on obtainable financial data. Another technique for analyzing year-to-year performance is benchmarking towards trade requirements.

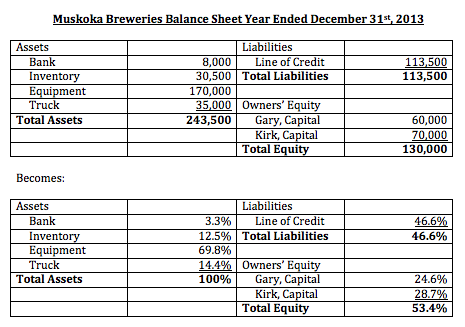

Learning the percentages on the balance sheet might lead to several different observations. Subsequent, research Column (4), which expresses as a share the dollar change in Column (3). Frequently, these share will increase are extra informative than absolute amounts, as illustrated by the current asset changes. The percentages reveal that present assets elevated .5% which if we in contrast this to present liabilities would give us an thought if the company may pay their debt in the future.

Businesses ought to ensure that they’ve the necessary sources and experience to conduct thorough monetary evaluation and make informed selections primarily based on the insights gained from this analysis. They help you see how your performance stacks up 12 months over yr, which is super useful for making knowledgeable selections. Plus, it may give you insights into areas where you might need to enhance or invest extra. The analysis of comparative financial statements is extremely crucial for all companies or traders. Having data for two or extra years offers us a glance of what’s working and what’s not within the enterprise.

Comparative Financial Statements: Varieties, Evaluation & Key Tendencies

Finally, the accurate interpretation of those financial statements is prime for making informed monetary decisions and efficient strategic planning. This process involves inspecting historical financial data to establish the most related time periods for comparability, making certain that the chosen durations provide insights into the company’s monetary efficiency and place. Development evaluation performs a vital position on this selection, because it helps in figuring out patterns and fluctuations over time, enabling a deeper understanding of the company’s monetary dynamics. They could not present a whole image of a company’s financial health and can be affected by accounting decisions or modifications in business requirements. Tracking and analyzing monetary efficiency is crucial for understanding and visualizing the progress of your company over time. By keeping a close eye on your financial knowledge, you’ll have the ability to observe progress, identify trends, and make informed choices to drive growth and success.

Total, it is essential to consider multiple ratios and indicators when analyzing comparative monetary statements. Each ratio supplies a unique perspective on an organization’s monetary health, and no single ratio can present a whole image. By analyzing multiple ratios, buyers and stakeholders can achieve a complete understanding of a company’s financial scenario and make knowledgeable decisions about its future prospects. This comparison helps stakeholders in understanding the modifications in income, bills, property, and liabilities over time. For occasion, analyzing the revenue statement over two consecutive years permits the management to determine trends in sales development or price structure, offering priceless insights into the company’s operational effectivity.